Event Types

The following event types are available. Please note that some event types are restricted to certain types of webhook subscription.

- Event type:

transfers#state-change - Profile level subscriptions: Supported

- Application level subscriptions: Supported

This event will be triggered every time a transfer's status is updated. Each event contains a timestamp. As we do not guarantee the order of events, please use data.occurred_at to reconcile the order.

If you would like to subscribe to transfer state change events, please use transfers#state-change when creating your subscription.

Note that for all topup-to-balance transfers created, transfers#state-change events will NOT be triggered. To listen to these, subscribe to balances#update webhook.

Transfer resource type (always transfer)

ID of the transfer

ID of the profile that owns the transfer

ID of transfer's recipient account

Current transfer state (see transfer statuses)

Previous transfer state (see transfer statuses) - Note that this will be null for newly created transfers.

When the state change occurred.

You should use a subscription to application webhooks to keep the statuses of your local transfer data storage up to date. The transfers will move through the following statuses in the happy path.

Incoming Payment Waiting ⇒ Processing ⇒ Funds Converted ⇒ Outgoing Payment Sent

Outgoing Payment Sent is the final state of the normal flow. If the payment fails, the following problematic flow will occur. An example would be if the recipient bank account doesn’t exist or the data is entered incorrectly and the payment is returned to Wise. The problematic state flow of transfers is:

Outgoing Payment Sent ⇒ Bounced Back ⇒ Processing ⇒ Cancelled ⇒ Funds Refunded

Most bounce backs occur within 2-3 business days, however this could happen up to several weeks after a transfer is sent.

Transfer state flow

NB: Transfers support rollback transitions. This allows transfers to return back to previous states.

See below for the full list of transfer statuses and what they mean in the order of occurrence.

incoming_payment_waiting – The transfer has been submitted and Wise is waiting for funding to be initiated.

incoming_payment_initiated - The funding has been initiated but the money has not yet arrived in Wise's account.

processing – We have received the funds and are processing the transfer. Processing is a generic term that means we’re doing behind-the-scene activities before the money gets sent to the recipient, such as AML, compliance and fraud checks.

funds_converted – All compliance checks have been completed for the transfer and funds have been converted from the source currency to the target currency.

outgoing_payment_sent – Wise has paid out funds to the recipient. This is the final state of the transfer, assuming funds will not be returned. When a transfer has this state, it doesn’t mean the money has arrived in the recipient’s bank account, just that we have sent it from ours. Note: Payment systems in different countries operate in different speeds and frequency. For example, in the UK, the payment will reach the recipient bank account within few minutes after we send the outgoing payment. However, in the US it usually takes a day until funds are received.

cancelled – This status is used when the transfer was never funded and therefore never processed. This is a final state of the transfer.

funds_refunded – Transfer has been refunded. This is a final state of the transfer.

bounced_back – Transfer has bounced back but has not been cancelled nor refunded yet. This is not a final transfer state, it means the transfer will either be delivered after a delay or it will turn to funds_refunded state.

charged_back - This status is used when we have a problem debiting payer's account or the payer requested money back. Chargeback can happen from any other state.

unknown - This status is used when we don’t have enough information to move the transfer into a final state. We send out an email for more information. For example sender account details to refund money back.

Keep in mind the transfer statuses in our API have different names than what you’ll see on our website or app. That’s because we use more consumer friendly language in the front end of our products. For example "Completed" on our website means outgoing_payment_sent in the API.

You should use the following descriptions in your website or app for the potential statuses we return:

| Status | Description |

|---|---|

| incoming_payment_waiting | "On its way to Wise" |

| incoming_payment_initiated | "On its way to Wise" |

| processing | "Processing" |

| funds_converted | "Processing" |

| outgoing_payment_sent | "Sent" |

| charged_back | "Charged back" |

| cancelled | "Cancelled" |

| funds_refunded | "Refunded" |

| bounced_back | "Bounced back" |

| unknown | "Unknown" |

{"data": {"resource": {"type": "transfer","id": 111,"profile_id": 222,"account_id": 333},"current_state": "processing","previous_state": "incoming_payment_waiting","occurred_at": "2020-01-01T12:34:56Z"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "transfers#state-change","schema_version": "2.0.0","sent_at": "2020-01-01T12:34:56Z"}

- Event type:

transfers#active-cases - Profile level subscriptions: Supported

- Application level subscriptions: Not Supported

This event will be triggered every time a transfer's list of active cases is updated. Active cases indicate potential problems with transfer processing.

If you would like to subscribe to transfer active cases events, please use transfers#active-cases when creating your subscription.

Transfer resource type (always transfer)

ID of the transfer

ID of the profile that owns the transfer

ID of transfer's recipient account

Ongoing issues related to the transfer

{"data": {"resource": {"type": "transfer","id": 111,"profile_id": 222,"account_id": 333},"active_cases": ["deposit_amount_less_invoice"]},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "transfers#active-cases","schema_version": "2.0.0","sent_at": "2020-01-01T12:34:56Z"}

- Event type:

transfers#payout-failure - Profile level subscriptions: Supported

- Application level subscriptions: Supported

This event will be triggered every time a payout fails. The event can be used to get further information about a failed payment.

transfers#state-change event provides high level information about the state of transfers. But it doesn't provide details about payout failures.

While the transfers#state-change event is in outgoing_payment_sent state, the payout could fail for certain reasons listed below.

Using this event, you can understand the reason behind the failure and even ask your customers to fix the problem by themselves. If the failure reason code is WRONG_ACCOUNT_NUMBER for example.

Please note that not every payout failure will trigger a transfers#state-change. For example a payout might fail with MANDATE_NOT_FILLED_IN code but the corresponding transfer might stay in the same state.

We recommend to process both event types(transfers#payout-failure and transfers#state-change) separate from each other.

If you would like to subscribe to payout failure events, please use transfers#payout-failure when creating your subscription.

ID of the transfer

ID of the profile that initiated the transfer

Code of the failure error

Description of the failure code

When the state change occurred

Table of available failure reason codes and descriptions

| Code | Description |

|---|---|

| ACCOUNT_CLOSED | The recipient details are correct, but beneficiary account is closed |

| ACCOUNT_FROZEN | The recipient details are correct, but beneficiary account is frozen |

| ACCOUNT_BLOCKED | The recipient details are correct, but beneficiary account is blocked |

| ACCOUNT_LIMIT_REACHED | The recipient details are correct, but beneficiary account has a limit that can be unblocked by the recipient |

| WRONG_ACCOUNT_NUMBER | Invalid account number |

| WRONG_CARD_NUMBER | Invalid card number |

| WRONG_ACCOUNT_DETAILS | Invalid account number AND/OR invalid bank code |

| WRONG_ACCOUNT_TYPE | Incorrect account type |

| WRONG_BANK_CODE | Invalid sort/BIC/routing/etc number |

| WRONG_BRANCH_CODE | Invalid branch code |

| WRONG_NAME | Account number matches, but the name is not 100% correct |

| WRONG_PHONE_NUMBER | Recipient phone number is incorrect |

| WRONG_ID_NUMBER | Invalid recipient's ID document number |

| WRONG_RUT_NUMBER | Invalid recipient's RUT (Rol Único Tributario) number |

| TAX_ID_NOT_MATCHING | Tax ID doesn't match recipient's name |

| TAX_ID_SUSPENDED | Tax ID is suspended |

| WRONG_REFERENCE | Invalid payment reference |

| WRONG_PAYMENT_PURPOSE | Invalid or not accepted payment purpose |

| ACCOUNT_DOES_NOT_EXIST | Format is correct but this account does not exist in recipient bank |

| WRONG_CURRENCY | Recipient account is in different currency |

| WRONG_CARD_TYPE | Recipient account doesn't support payments to this card type |

| CANNOT_ACCEPT_FROM_3RD_PARTY | Recipient bank can't accept the payments from 3rd party |

| CREDITING_ACCOUNT_FORBIDDEN | Terms and Conditions of Account do not permit crediting of these funds |

| DUPLICATE_ENTRY | Recipient bank informs that there has been another payment in the same amount |

| FUNDS_NOT_EXPECTED_RETURNED | Beneficiary not expecting funds/instructed return |

| MANDATE_NOT_FILLED_IN | Recipient didn't fill out the mandate form on time or the email address is incorrect |

| BUSINESS_PAYMENTS_FORBIDDEN | Payment to business accounts are not allowed |

| DUPLICATE_ENTRY | Recipient bank informs that there has been another payment in the same amount |

| SENDER_REQUESTED_TO_CANCEL | Sender requested cancellation |

| REQUEST_FOR_INFORMATION_EXPIRED | Request for information expired |

| RETURN_REQUESTED_BY_RECIPIENT | Recipient requested return |

| EXTERNAL_IDENTIFIER_DETAILS_HAVE_CHANGED | External identifier details have changed |

| REASON_NOT_SPECIFIED | Reason not specified |

Wise could add new failure codes to this list and your system should be able to handle the events even if the failure reason code is not recognised.

{"data": {"transfer_id": 111,"profile_id": 222,"failure_reason_code": "WRONG_ID_NUMBER","failure_description": "Invalid recipient's ID document number","occurred_at": "2023-08-10T10:17:23.000+00:00"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "transfers#payout-failure","schema_version": "2.0.0","sent_at": "2023-08-10T10:17:28Z"}

- Event type:

transfers#refund - Profile level subscriptions: Supported

- Application level subscriptions: Supported

This event will be triggered every time a transfer's status becomes funds_refunded. Each event contains a timestamp. As we do not guarantee the order of events, please use data.occurred_at to reconcile the order.

This event provides information about refund amount and currency.

If you would like to subscribe to transfer refund events, please use transfers#refund when creating your subscription.

Transfer resource type (always transfer)

ID of the transfer

Identifies the Wise profile associated with this refund

ID referring to the initial beneficiary of the payment. The ultimate beneficiary is the sender the funds are being refunded to.

The total amount that was refunded to the customer. Includes any applicable fees.

The three-letter ISO currency code representing the currency in which the refund was issued.

The date and time the refund was triggered

{"data": {"resource": {"type": "transfer","id": 111,"profile_id": 222,"account_id": 333,"refund_amount": 5000,"refund_currency": "EUR"},"occurred_at": "2024-01-01T12:34:56Z"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "transfers#refund","schema_version": "1.0.0","sent_at": "2024-01-01T12:34:56Z"}

- Event type:

account-details-payment#state-change - Profile level subscriptions: Supported

- Application level subscriptions: Supported

This event will be triggered every time a pay-in is made into the specified account details.

Account detail ID where the pay-in was received

Balance ID which is linked to the account detail

Balance ID which is linked to the account detail

ID of the profile that owns the payment

ID of the incoming transfer

Type of the transfer

Transfer amount

Currency code

Sender name

Sender account number

Sender bank code

Sender address

Status of either PROCESSING, COMPLETED, CANCELLED or REFUNDED

Status of either PROCESSING, COMPLETED, CANCELLED or REFUNDED

Timestamp when the event occurred

{"data": {"account_details_id": "1","target_account_id": "12345","resource": {"id": 12345,"profile_id": 1},"transfer": {"id": "36c3f762-560d-4f07-84f9-5d8a3cacabbb","type": "credit","amount": 1.23,"currency": "EUR"},"sender": {"name": "Test Sender","account_number": "12345678","bank_code": "TESTBANK","address": "Test Address"},"current_status": "PENDING","previous_status": null,"occurred_at": "2024-01-01T12:34:56Z"},"subscription_id": "36c3f762-560d-4f07-84f9-5d8a3cacabbb","event_type": "account-details-payment#state-change","schema_version": "2.0.0","sent_at": "2024-01-01T12:34:56Z"}

New balance webhook is released The new webhook is triggered every time a multi-currency account is credited or debited . For more information: Balance update event

- Event type:

balances#credit - Profile level subscriptions: Supported

- Application level subscriptions: Not Supported

This event will be triggered every time a multi-currency account is credited.

If you would like to subscribe to balance credit events, please use balances#credit when creating your subscription.

Resource type (always balance-account)

ID of the account

ID of the profile that owns the account

Always credit

Deposited amount

Currency code

Balance after the credit was applied

When the credit occurred

{"data":{"resource":{"type":"balance-account","id":111,"profile_id":222},"transaction_type":"credit","amount":1.23,"currency":"EUR","post_transaction_balance_amount":2.34,"occurred_at":"2020-01-01T12:34:56Z"},"subscription_id":"01234567-89ab-cdef-0123-456789abcdef","event_type":"balances#credit","schema_version":"2.0.0","sent_at":"2020-01-01T12:34:56Z"}

- Event type:

balances#update - Profile level subscriptions: Supported

- Application level subscriptions: Supported

This event will be triggered every time a multi-currency account is credited or debited. If you would like to subscribe to balance update events, please use balances#update when creating your subscription.

For tracking events related to a single transaction such as a cancelled card transaction, please use data.step_id to reconcile the order.

Resource type (always balance-account)

ID of the account

ID of the profile that owns the account

Transaction amount

ID of the balance credited or debited

Transfer category

Currency code

When the transaction occurred

Available balance after current transaction

Unique identifier for tracking sequence of transaction events

Either credit or debit

ID of the transfer

{"data": {"resource": {"id": 2,"profile_id": 2,"type": "balance-account"},"amount": 70,"balance_id": 111,"channel_name": "TRANSFER","currency": "GBP","occurred_at": "2023-03-08T14:55:38Z","post_transaction_balance_amount": 88.93,"step_id": 1234567,"transaction_type": "credit","transfer_reference": "BNK-1234567"},"subscription_id": "f2264fe5-a0f5-4dab-a1b4-6faa87761425","event_type": "balances#update","schema_version": "3.0.0","sent_at": "2023-03-08T14:55:39Z"}

{"data": {"resource": {"id": 2,"profile_id": 2,"type": "balance-account"},"amount": 9.6,"balance_id": 111,"channel_name": "TRANSFER","currency": "GBP","occurred_at": "2023-03-08T15:26:07Z","post_transaction_balance_amount": 106.93,"step_id": 1234567,"transaction_type": "debit","transfer_reference": "47500002"},"subscription_id": "f2264fe5-a0f5-4dab-a1b4-6faa87761425","event_type": "balances#update","schema_version": "3.0.0","sent_at": "2023-03-08T15:26:07Z"}

Resource type (always balance-account)

ID of the account

ID of the profile that owns the account

Either credit or debit

Transaction amount

ID of the balance credited or debited

Currency code

When the transaction occurred

ID of the transfer

transfer category

{"data": {"resource": {"id": 2,"profile_id": 2,"type": "balance-account"},"amount": 70,"balance_id": 111,"currency": "GBP","transaction_type": "credit","occurred_at": "2023-03-08T14:55:38Z","transfer_reference": "BNK-1234567","channel_name": "TRANSFER"},"subscription_id": "f2264fe5-a0f5-4dab-a1b4-6faa87761425","event_type": "balances#update","schema_version": "2.2.0","sent_at": "2023-03-08T14:55:39Z"}

{"data": {"resource": {"id": 2,"profile_id": 2,"type": "balance-account"},"amount": 9.6,"balance_id": 111,"currency": "GBP","transaction_type": "debit","occurred_at": "2023-03-08T15:26:07Z","transfer_reference": "47500002","channel_name": "TRANSFER"},"subscription_id": "f2264fe5-a0f5-4dab-a1b4-6faa87761425","event_type": "balances#update","schema_version": "2.2.0","sent_at": "2023-03-08T15:26:07Z"}

Resource type (always balance-account)

ID of the account

ID of the profile that owns the account

Either credit or debit

Transaction amount

Currency code

When the transaction occurred

ID of the transfer

transfer category

{"data": {"resource": {"id": 2,"profile_id": 2,"type": "balance-account"},"amount": 70,"currency": "GBP","transaction_type": "credit","occurred_at": "2023-03-08T14:55:38Z","transfer_reference": "BNK-1234567","channel_name": "TRANSFER"},"subscription_id": "f2264fe5-a0f5-4dab-a1b4-6faa87761425","event_type": "balances#update","schema_version": "2.1.0","sent_at": "2023-03-08T14:55:39Z"}

{"data": {"resource": {"id": 2,"profile_id": 2,"type": "balance-account"},"amount": 9.6,"currency": "GBP","transaction_type": "debit","occurred_at": "2023-03-08T15:26:07Z","transfer_reference": "47500002","channel_name": "TRANSFER"},"subscription_id": "f2264fe5-a0f5-4dab-a1b4-6faa87761425","event_type": "balances#update","schema_version": "2.1.0","sent_at": "2023-03-08T15:26:07Z"}

- Event type:

balances#account-state-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event will be triggered every time a balance account is activated or deactivated

If you would like to subscribe to balance account state change events, please use balances#account-state-change when creating your subscription.

Resource type (always balance-account)

ID of the account

ID of the profile that owns the account

State of the account.

Values:

- ACTIVE

- INACTIVE

Timestamp when the event occurred

{"data":{"resource":{"type":"balance-account","id": 123,"profile_id": 555,"state": "INACTIVE"},"occurred_at":"2020-01-01T12:34:56Z"},"subscription_id":"01234567-89ab-cdef-0123-456789abcdef","event_type":"balances#account-state-changed","schema_version":"2.0.0","sent_at":"2020-01-01T12:34:56Z"}

- Event type:

profiles#verification-state-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event will be triggered when the verification state of a connected profile changes.

A profile's verification state can be verified or not_verified. If the state is verified, then the user is ready to make payments using Wise. If the state is not_verified, then we advise not to initiate any transfers with the user's access token as the payments will not be processed until the verification is completed.

If you would like to subscribe to verification state change events, please use profiles#verification-state-change when creating your subscription.

Profile resource type (always profile)

ID of the profile

Current verification state of the profile (see discussion above)

When the verification state change occurred

{"data": {"resource": {"type": "profile","id": 111},"current_state": "verified","occurred_at": "2020-01-01T12:34:56Z"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "profiles#verification-state-change","schema_version": "2.0.0","sent_at": "2020-01-01T12:34:56Z"}

- Event type:

batch-payment-initiations#state-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event will be triggered when the payment initiation state of a batch group payment changes.

The expected state of a batch payment initiation can be one of: NEW, PROCESSING, COMPLETED, FAILED, CHARGED_BACK.

If you would like to subscribe to batch payment initiation state change events, please use batch-payment-initiations#state-change when creating your subscription.

Payment initiation ID

Batch group ID

The ID of the profile this payment belongs to

Previous payment initiation state

Current payment initiation state

When the payment initiation state change occurred

Return code of the underlying payment system

{"data": {"resource": {"id": 12345,"batchGroupId": "068e186d-9632-4937-b753-af3e53f4d0b0","profileId": 2},"previousStatus": "NEW","newStatus": "PROCESSING","occurredAt": "2021-04-13T19:51:41.423404Z" ,"returnCode": "200"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "batch-payment-initiations#state-change","schema_version": "2.0.0","sent_at": "2020-01-01T12:34:56Z"}

- Triggering event type:

swift-in#credit - Profile level subscriptions: Supported

- Application level subscriptions: Supported

This webhook will be sent every time a Swift message is received and a credit is deposited into a balance account.

If you also subscribe to balances#credit or transfers#state-change on the same profile or application you may experience some duplication of webhook events. You should make allowances for this and handle it in your implementation.

Type of action.

Mandatory

Format: always credit

TransferID of the credit.

Mandatory

ProfileID for the transfer.

Mandatory

AccountID for the transfer.

Mandatory

ID of the webhook.

Mandatory

Unique identifier created by the scheme for each payment and passed through the scheme to Wise.

Mandatory

Length: 36 Characters

Reference provided by the ultimate sender for the payment.

Optional

Length: Min 0 Max 140 Characters

Name of the ultimate recipient.

Optional

Length: Min 1 Max 140 Characters

Address of the ultimate recipient.

Optional

Length: Min 1 Max 140 Characters

This can be either an IBAN, BBAN, AccountId or a Descriptor (another kind of identifier).

Optional

Length: Min 1 Max 36 Characters

Name of the ultimate sender.

Optional

Length: Min 1 Max 140 Characters

Address of the ultimate sender.

Optional

Length: Min 1 Max 140 Characters

This can be either an IBAN, BBAN, AccountId or a Descriptor (another kind of identifier).

Optional

Length: Min 1 Max 36 Characters

Value of the ultimate sender’s bank code.

Optional

Type of the ultimate sender’s bank code.

Optional

In case the originally instructed amount was converted by Wise or any other intermediary agent, this field contains the exchange rate used. If no conversion took place, the exchange rate will be 1.0.

Mandatory

Amount originally instructed by the ultimate sender.

Optional

Value of the amount originally instructed by the ultimate sender.

Mandatory

Currency of the amount originally instructed by the ultimate sender.

Mandatory

Length: Exactly 3 Characters

Format: 3-letter ISO currency code

Value of the amount settled to the balance account.

Mandatory

Currency of the amount settled to the balance account.

Mandatory

Length: Exactly 3 Characters

Format: 3-letter ISO currency code

List of fees applied by Wise (e.g., conversion fee). If this list is empty, no fees were applied by Wise.

Optional

Type of fee.

Mandatory

Format: conversion,

Value of fee.

Mandatory

Currency of fee.

Mandatory

Length: Exactly 3 Characters

Format: 3-letter ISO currency code

List of fees declared by correspondents (e.g., handling fee). If this list is empty, no fees were declared by correspondents.

Optional

Value of fee.

Mandatory

Currency of fee.

Mandatory

Length: Exactly 3 Characters

Format: 3-letter ISO currency code

Date and time at which the associated transaction was created. Time in UTC.

Mandatory

Length: Exactly 20 Characters

Format: YYYY-MM-DDTHH:MM:SSZ

Date and time at which the amount was credited to the balance account. Time in UTC.

Mandatory

Length: Exactly 20 Characters

Format: YYYY-MM-DDTHH:MM:SSZ

{"data": {"action": {"type": "credit","id": 12345,"profile_id": 222,"account_id": 333},"resource": {"id": "55555","uetr": "f875814b-7d44-4d1b-a499-123456789abcde","reference": "/RFB/BET072","recipient": {"name": "JOHN SMITH","address": "EVERGREEN AVE, 6, BRUSSELS, BE","account": "BE1234567891234"},"sender": {"name": "GEORGE SMITH","address": "EVERGREEN STREET, 10, BRUSSELS, BE","account": "EE947700771111111111","bank_code": {"value": "ABNABE2AIDJ","type": "BIC"}},"exchange_rate": 0.8,"instructed_amount": {"value": 1000,"currency": "USD"},"settled_amount": {"value": 786.54,"currency": "GBP"},"fee": {"wise": [{"type": "conversion","value": 2.76,"currency": "GBP"}],"correspondent": [{"value": 4.5,"currency": "USD"},{"value": 2.1,"currency": "GBP"},{"value": 5,"currency": "GBP"}]},"transaction_time": "2023-08-21T12:34:56Z"},"occurred_at": "2023-08-21T12:34:56Z"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "swift-in#credit","schema_version": "3.0.0","sent_at": "2023-08-21T12:34:58Z"}

- Event type:

cards#transaction-state-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event will be triggered whenever a new card transaction occurs or is modified.

Transactions can be categorized based on the guidelines below, though the results may not always be consistent.

- Active card check –

transaction_amountis 0 or 1 andmerchant.category.codenot equals6011 - ATM balance check –

transaction_amountis 0 andmerchant.category.codeequals6011 - Pre-Authorisation –

is_amount_confirmedis false andtransaction_stateequalsIN_PROGRESS

ID of the profile that owns the card

Your api_client_id

Unique identifier of the card

Last 4 digits of the card

Resource type (always card)

ID of the transaction

Type of the transaction

Indicates whether the transaction type is a debit. This field is deprecated, use data.transaction_amount.value to determine if the transaction is a debit (positive) or a credit into the balance (negative).

Step type of the transaction

Code of the decline reason if applicable

The current state of the transaction

Transaction amount

Currency code

Whether the transaction amount is confirmed

Fee amount

Currency code

Fee type

Transaction amount including fees

Currency code

Billing amount

Currency code

Authorisation method

PIN validation result. Possible values: ONLINE_PIN_VALIDATED, ONLINE_PIN_INVALID, OFFLINE_PIN_VALIDATED, OFFLINE_PIN_INVALID, NOT_RECEIVED

Also called authorization code. This can be used to prove ownership of a customer's card/account to a merchant

Time at which reserved funds will be released after the authorisation hold expires

Associated balance transaction id if applicable

When the balance movement occurred

ID of the balance credited or debited

credit or debit

Credited or debited amount

Currency code

Balance ID

Amount taken from the balance

Currency code

Amount converted to

Currency code

Exchange rate

Conversion fee amount

Currency code

Balance ID

Amount credited to the balance

Currency code

Name of the merchant

Country where merchant is located

City where merchant is located

Post code where merchant is located

State where merchant is located

Merchant category code

Merchant category description

Acquirer reference number

When transaction was created

When transaction or transaction state change occurred

Table of available transaction state and descriptions

| Code | Description |

|---|---|

| IN_PROGRESS | The transaction is still in progress |

| COMPLETED | The transaction is completed |

| DECLINED | The transaction has been declined |

| CANCELLED | The transaction has been cancelled |

| UNKNOWN | Default fallback status |

Table of available transaction type and descriptions

| Code | Description |

|---|---|

| ACCOUNT_CREDIT | Receiving money on the card, excluding Visa OCT or Mastercard MoneySend |

| ACCOUNT_FUNDING | Sending money to another card or e-wallet |

| CASH_ADVANCE | Cash disbursement |

| CASH_WITHDRAWAL | ATM withdrawal |

| CHARGEBACK | Currently unused. Reserved for future use. |

| CREDIT_TRANSACTION | Visa OCT and Mastercard MoneySend |

| ECOM_PURCHASE | Online purchase |

| POS_PURCHASE | Purchase via a POS Terminal |

| REFUND | Partial or full refund of an existing card transaction |

Table of available transaction step type and descriptions

| Code | Description |

|---|---|

| AUTH | Transaction authorization which is usually the first step |

| PARTIAL_REVERSAL | Transaction has been partially reversed |

| FULL_REVERSAL | Transaction has been fully reversed |

| CAPTURE | Transaction has been caputured |

| SETTLE | Currently unused. Reserved for future use. |

| REFUND | Currently unused. Reserved for future use. |

| RECONCILIATION | Currently unused. Reserved for future use. |

Table of available fee type and descriptions

| Code | Description |

|---|---|

| ATM_WITHDRAWAL | Fee charged by Wise |

| ATM_MACHINE | Fee charged by the ATM owner |

{"data": {"resource": {"profile_id": 123456,"client_id": "your-bank","card_token": "136b29e4-7eab-4dac-a017-438d494ef6cb","card_last_digits": "1234","type": "card"},"transaction_id": 12345,"transaction_type": "CASH_WITHDRAWAL","is_debit": true,"transaction_step_type": "CAPTURE","decline_reason": null,"transaction_state": "COMPLETED","transaction_amount": {"value": 100.00,"currency": "EUR"},"is_amount_confirmed": true,"fees": [{"amount": 1.00,"currency": "EUR","fee_type": "ATM_WITHDRAWAL"}],"transaction_amount_with_fees": {"value": 101.00,"currency": "EUR"},"billing_amount": {"value": 100.00,"currency": "EUR"},"authorisation_method": "CHIP_AND_PIN","pin_validation_result": "ONLINE_PIN_VALIDATED","approval_code": "913647","purge_time": "2022-08-22T11:10:41Z","balance_transaction_id": 12345,"balance_movements": [{"creation_time": "2024-12-02T04:17:40Z","balance_id": 123,"type": "debit","amount": {"currency": "AUD","value": 165.96}}],"debits": [{"balance_id": 123,"debited_amount": {"value": 165.96,"currency": "AUD"},"for_amount": {"value": 101.00,"currency": "EUR"},"rate": 0.61223252,"fee": {"value": 0.99,"currency": "AUD"}}],"credit": null,"merchant": {"name": "Test Payment","location": {"country": "France","city": "Rouen","postCode": "00000","state": null},"category": {"code": "6011","description": "6011 Z Member Financial Institution"}},"arn": "04300014127798385983852","creation_time": "2022-08-15T11:10:41Z","occurred_at": "2022-08-15T11:10:41Z"},"subscription_id": "568da36b-7335-4608-ad1b-e5c2d32273b6","event_type": "cards#transaction-state-change","schema_version": "2.0.0","sent_at": "2022-08-15T11:10:46Z"}

{"data": {"arn": null,"authorisation_method": "CHIP_AND_PIN","pin_validation_result": "ONLINE_PIN_VALIDATED","purge_timestamp": "2024-11-13T06:40:49Z","purge_time": "2024-11-13T06:40:49Z","approval_code": "913647","balance_transaction_id": 5543970,"balance_movements": [{"creation_time": "2024-11-13T06:41:20Z","balance_id": 124741,"type": "debit","amount": {"currency": "SGD","value": 10}},{"creation_time": "2024-11-13T06:41:48Z","balance_id": 124741,"type": "credit","amount": {"currency": "SGD","value": 10}}],"billing_amount": {"currency": "SGD","value": 10},"creation_time": "2024-11-13T06:41:20Z","credit": null,"debits": [{"balance_id": 124741,"debited_amount": {"currency": "SGD","value": 0},"fee": {"currency": "SGD","value": 0},"for_amount": {"currency": "SGD","value": 0},"rate": 1}],"decline_reason": null,"fees": [],"is_amount_confirmed": true,"is_debit": true,"merchant": {"category": {"code": "5912","description": "Drug Stores, Pharmacies"}},"occurred_at": "2024-11-13T06:41:49Z","resource": {"card_last_digits": "7223","card_token": "495980f9-719e-4e60-0d3b-812ab0c5c5a4","client_id": "tw-test-connected-apps","profile_id": 16605997,"type": "card"},"transaction_amount": {"currency": "SGD","value": 10},"transaction_amount_with_fees": {"currency": "SGD","value": 10},"transaction_id": 5255,"transaction_state": "CANCELLED","transaction_step_type": "FULL_REVERSAL","transaction_type": "POS_PURCHASE"},"event_type": "cards#transaction-state-change","schema_version": "2.0.0","sent_at": "2024-11-13T06:41:49Z","subscription_id": "568da36b-7335-4608-ad1b-e5c2d32273b6"}

- Event type:

profiles#cdd-check-state-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event pushes updates for Additional Customer Verification process.

Profile resource type (always set to profile)

ID of the profile

Current verification state of the profile (see table below)

Optional

Reason the verification review did not pass.

Refer to the table below for description on these reasons.

List of required evidences for verification.

Refer to the table below for description on how to provide the missing evidence.

When the CDD check state change occurred

Optional

Source of income for a personal profile submitted via the /upload-evidences API.

Use this to upload the correct Source of Wealth document.

Optional

Source of funding for a business profile submitted via the /upload-evidences API.

Use this to upload the correct Source of Wealth document.

Verification state values

| Code | Description |

|---|---|

| VERIFIED | Additional verification check has passed |

| EVIDENCE_REQUIRED | Additional verification check has failed, evidences are required |

| Code | Description |

|---|---|

| DOCUMENT_POOR_QUALITY | Document quality poor |

| DOCUMENT_OUT_OF_DATE | Document out of date |

| DOCUMENT_NAME_MISMATCH | Name on document does not match records |

| DOCUMENT_MISSING_NAME | Name on document missing |

| DOCUMENT_MISSING_ISSUE_DATE | Document issue date missing |

| DOCUMENT_MISSING_COMPANY_LOGO_LETTERHEAD | Company logo or letterhead missing from document |

| DOCUMENT_NOT_COMPLETE | Document is partially cut-off and does not contain full information |

| DOCUMENT_MISSING_SIGNATURE | Document missing signature |

| DOCUMENT_MISSING_INCOME | Document missing income information or income is not clear from the document |

| DOCUMENT_TYPE_UNACCEPTABLE | Submitted document type is not acceptable |

| INVOICE_UNACCEPTABLE | Invoice is not an accepted document |

| PHOTO_ID_UNACCEPTABLE | Photo ID is not an accepted document |

| TRANSACTION_UNACCEPTABLE | Transaction (or a screenshot of a transaction) is not accepted |

| PHOTO_UNACCEPTABLE | Photos (or computer screenshots) are not acceptable |

| OTHER | Reason unknown |

Go to the list of evidences to find all possible values.

{"data": {"resource": {"type": "profile","id": 111},"current_state": "VERIFIED","required_evidences": [],"occurred_at": "2020-01-01T12:34:56Z"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "profiles#cdd-check-state-change","schema_version": "2.0.0","sent_at": "2020-01-01T12:34:56Z"}

{"data": {"resource": {"type": "profile","id": 111},"current_state": "EVIDENCE_REQUIRED","review_outcome": "Document is not acceptable","required_evidences": ["SOURCE_OF_INCOME"],"source_of_income": "INVESTMENTS","occurred_at": "2020-01-01T12:34:56Z"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "profiles#cdd-check-state-change","schema_version": "2.0.0","sent_at": "2020-01-01T12:34:56Z"}

- Event type:

cards#card-status-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event is triggered for the initial card status as well as any subsequent updates.

ID of the profile that owns the card

Your api_client_id

Unique identifier of the card

Resource type (always card)

The updated card status

The identifier of the entity that updated the card status. If changed by Wise, the value is set to internal_system, otherwise, it is set to your api_client_id

When the card status change occurred

Table of available card status and descriptions

| Code | Description |

|---|---|

| ACTIVE | Card is active and can be used |

| INACTIVE | Card is inactive and all transactions will be declined |

| BLOCKED | Card is blocked and cannot be reversed back to any state |

| FROZEN | Card is “blocked” but temporarily |

| PARTNER_SUSPENDED | Card is suspended by Wise temporarily due to e.g. fraud reasons |

| EXPIRED | Card is expired |

| PURGED | The cardhoder data (e.g. PAN, PIN) have been purged after exceeds the retention period (555 days after the card's expiry date) |

{"data": {"resource": {"profile_id": 123456,"client_id": "your-bank","card_token": "ABCD-1234-ABCD-1234-ABCD","type": "card"},"card_status": "FROZEN","changed_by": "internal_system","occurred_at": "2022-08-22T07:49:50Z"},"subscription_id": "ABCD-1234-ABCD-1234-ABCD","event_type": "cards#card-status-change","schema_version": "2.0.0","sent_at": "2022-08-22T07:59:50Z"}

- Event type:

cards#card-order-status-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event will be triggered every time a card order status is updated. Please note that statuses depend on the type of card (virtual/physical). Additional statuses related to delivery exist for physical cards.

ID of the profile that owns the card

Webhook notification of type 'card'

Api client_id

Unique identifier of the card

Card order ID associated with the status change

Updated card order status

Delivery vendor used to dispatch the order (physical card only)

When the card order status change occurred

{"data":{"resource":{"type": "card","profile_id": "123456","client_id": "your-bank","card_token": "35050a4a-9521-426e-8109-1396e3687a3e","card_program": "VISA_DEBIT_CONSUMER_UK_1_PHYSICAL_CARDS_API"},"order_id" : "1001L","order_status": "PRODUCED","delivery_vendor": "DHL","occurred_at":"2023-01-01T12:24:56Z"},"subscription_id":"01234567-89ab-cdef-0123-456789abcdef","event_type":"cards#card-order-status-change","schema_version":"2.0.0","sent_at":"2023-01-01T12:34:56Z"}

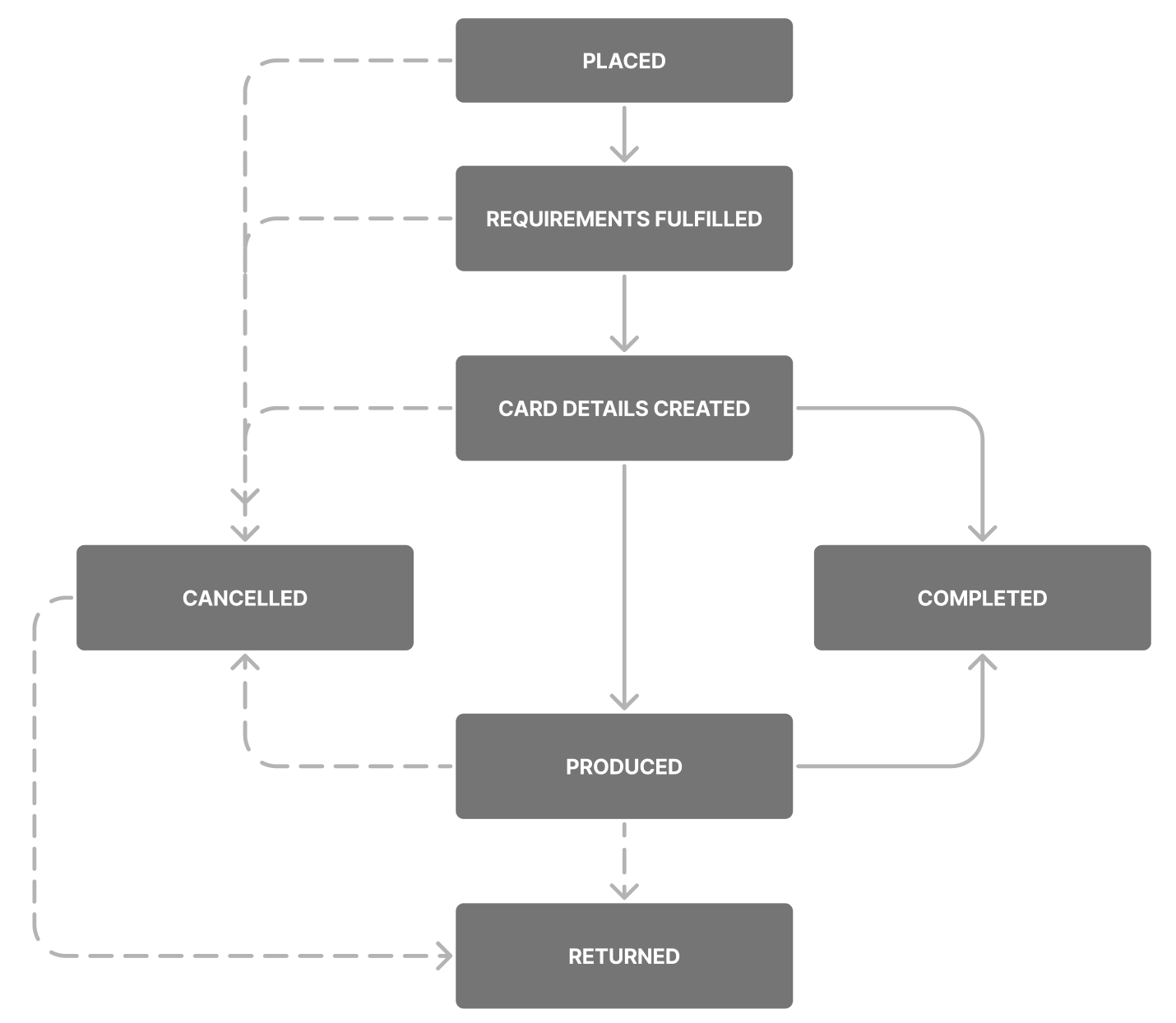

Table of available card order status and description

The initial status is PLACED or REQUIREMENT_FULFILLED depending on the requirement fulfillment state.

The possible values are shown in the table below:

| Status | Definition |

|---|---|

PLACED | The card order is created. The card will be generated once it has fulfilled all the requirements |

REQUIREMENTS_FULFILLED | The card order has fulfilled all the requirements and the card should be generated in a short while |

CARD_DETAILS_CREATED | The card has been generated |

PRODUCED | The physical card has been produced and waiting to be picked up by delivery vendor (physical card only) |

COMPLETED | The card has been activated and is ready to use. The card order is completed |

CANCELLED | The card order has been cancelled. This can happen if you reach out to Wise Support to cancel a card order |

RETURNED | Delivery failed, the physical card has been returned and will be blocked (physical card only) |

- Event type:

cards#card-production-status-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event will be triggered every time a card production status is updated. Please note that this webhook is solely used for physical card with KIOSK_COLLECTION delivery method.

Refer back to the card kiosk collection guide for more details.

ID of the profile that owns the card

Webhook notification of type 'card'

API client_id

Unique identifier of the card

Current production status. The possible values can be found in the production status flow diagram.

Identifier that specifies which kiosk machine is producing the card.

Time when the card production request has been sent to the kiosk machine.

Code returned when card production is not successful. The possible values can be found in production errors.

Detailed description of the error code.

{"data": {"resource": {"type": "card","profile_id": "123456","client_id": "your-bank","card_token": "35050a4a-9521-426e-8109-1396e3687a3e"},"status": "PRODUCED","kiosk_id": "WIS00001","error_code": null,"description": "Card produced","occurred_at": "2024-01-01T12:24:560Z"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "cards#card-production-status-change","schema_version": "2.0.0","sent_at": "2024-01-01T12:34:56Z"}

- Event type:

partner-support#case-changed - Profile level subscriptions: Not supported

- Application level subscriptions: Supported

This event will be triggered every time a partner case is updated, including if commented on or if the status is changed.

Note that you will also receive a webhook response when you have created a new case or updated a case.

Type of the partner case. Value must be GENERAL_ENQUIRY. More case types will be added in the future.

ID of the partner case

ID of the transfer that is associated with the partner case. This can be null.

ID of the profile that is associated with the partner case.

ID of the user account that is associated with the partner case.

Status of the case. Can include OPEN, PENDING, SOLVED and CLOSED.

Type of resource for webhook. Will always be partner-support-case

The type of the webhook being sent. Will be STATUS_UPDATED , NEW_COMMENT , or NEW_CASE

When the partner case update occurred.

{"data": {"resource": {"case_id": 136,"case_type": "GENERAL_ENQUIRY","details": {"transfer_id": 12345678,"user_id": 12345678,"profile_id": 12345678},"status": "PENDING","type": "partner-support-case"},"type": "NEW_CASE","occurred_at": "2023-06-23T09:45:34Z"},"subscription_id": "017631af-326c-4a69-93f3-bd1ce987a743","event_type": "partner-support#case-changed","schema_version": "2.0.0","sent_at": "2023-06-23T09:45:36Z"}

- Event type:

transaction-disputes#update - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event will be triggered every time a transaction dispute is submitted or updated.

Unique ID of the dispute

ID of the profile that owns the card

ID of the card transaction

Resource type (always transaction-dispute)

Dispute reason, you can find all the possible values here

Dispute overall status, it is either ACTIVE or CLOSED

Dispute detailed status, you can find all the possible values here

Explanation for subStatus

Time when the dispute was created

Creator of the dispute, it is currently set to the user id

Whether the dispute can be withdrawn

When the dispute updates occurred

{"data": {"resource": {"id": "39f893e3-4b0c-4850-9c5c-8cb8f4798a43","profile_id": 16605997,"transaction_id": 4337,"type": "transaction-dispute"},"reason": "WRONG_AMOUNT","status": "CLOSED","sub_status": "WITHDRAWN","status_message": "Withdrawn","created_at": "2024-04-18T06:17:12Z","created_by": "6097861","can_withdraw": false,"occurred_at": "2024-04-18T06:36:15Z"},"event_type": "transaction-disputes#update","schema_version": "2.0.0","sent_at": "2024-04-18T06:36:17Z","subscription_id": "7bb32a11-74ad-43b6-9505-3f5facbc87ed"}

- Event type:

bulk-settlement#payment-received - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event will be triggered when a bulk settlement fund is received. Once there is a match, meaning the amount for this settlement journal is fully settled, the amount_matched will be set to true. If it is not matched, check the difference between source_amount and target_amount to determine how much more needs to be paid. Please note that this event can also be triggered when our operations team reallocates funds between settlements. Therefore, the received_amount in version 2.0.0 of the webhook is inaccurate. Please use the latest version, 3.0.0.

Reference on settlement journal

Settlement currency

The amount Wise paid out on behalf of partner

Total settlement fund received for this settlement journal

Whether amount received matchs what is expected

When the settlement fund was received

{"data": {"resource": {"settlement_reference": "TPFB1111111","source_currency": "GBP","source_amount": -100.1,"target_amount": 100.1,"amount_matched": true},"occurred_at": "2024-04-18T06:36:15Z"},"event_type": "bulk-settlement#payment-received","schema_version": "3.0.0","sent_at": "2024-04-18T06:36:17Z","subscription_id": "f5b51f77-e14a-433b-9f7c-fc2834ffcff5"}

Reference on settlement journal

Settlement currency

Please be aware that this field is unreliable. Always refer to the target_amount field for the total amount paid, and check the difference between source_amount and target_amount to see how much more needs to be paid.

The amount Wise paid out on behalf of partner

Total settlement fund received for this settlement journal

Whether amount received matchs what is expected

When the settlement fund was received

{"data": {"resource": {"settlement_reference": "TPFB1111111","source_currency": "GBP","received_amount": 10.1,"source_amount": -100.1,"target_amount": 100.1,"amount_matched": true},"occurred_at": "2024-04-18T06:36:15Z"},"event_type": "bulk-settlement#payment-received","schema_version": "2.0.0","sent_at": "2024-04-18T06:36:17Z","subscription_id": "f5b51f77-e14a-433b-9f7c-fc2834ffcff5"}

- Event type:

users#state-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event will be triggered every time a user state is updated.

ID of the user

Resource type (always user)

The previous state of the user

The current state of the user

The type of deactivation, ACCOUNT_SUSPENSION or ACCOUNT_CLOSURE. If the type is ACCOUNT_SUSPENSION, it is possible for your customer support teams to appeal the deactivation by reaching out to Wise.

The reason for deactivation

When the user state change occurred

{"data": {"resource": {"id": 1234,"type": "user"},"previous_state": "ACTIVE","current_state": "WITHDRAW_ONLY","deactivation_type": "ACCOUNT_SUSPENSION","deactivation_reason": "REQUESTED_BY_CUSTOMER_CS","occurred_at": "2020-01-01T12:34:567Z"},"event_type": "users#state-change","schema_version": "2.0.0","sent_at": "2020-01-01T12:34:56Z","subscription_id": "f5b51f77-e14a-433b-9f7c-fc2834ffcff5"}

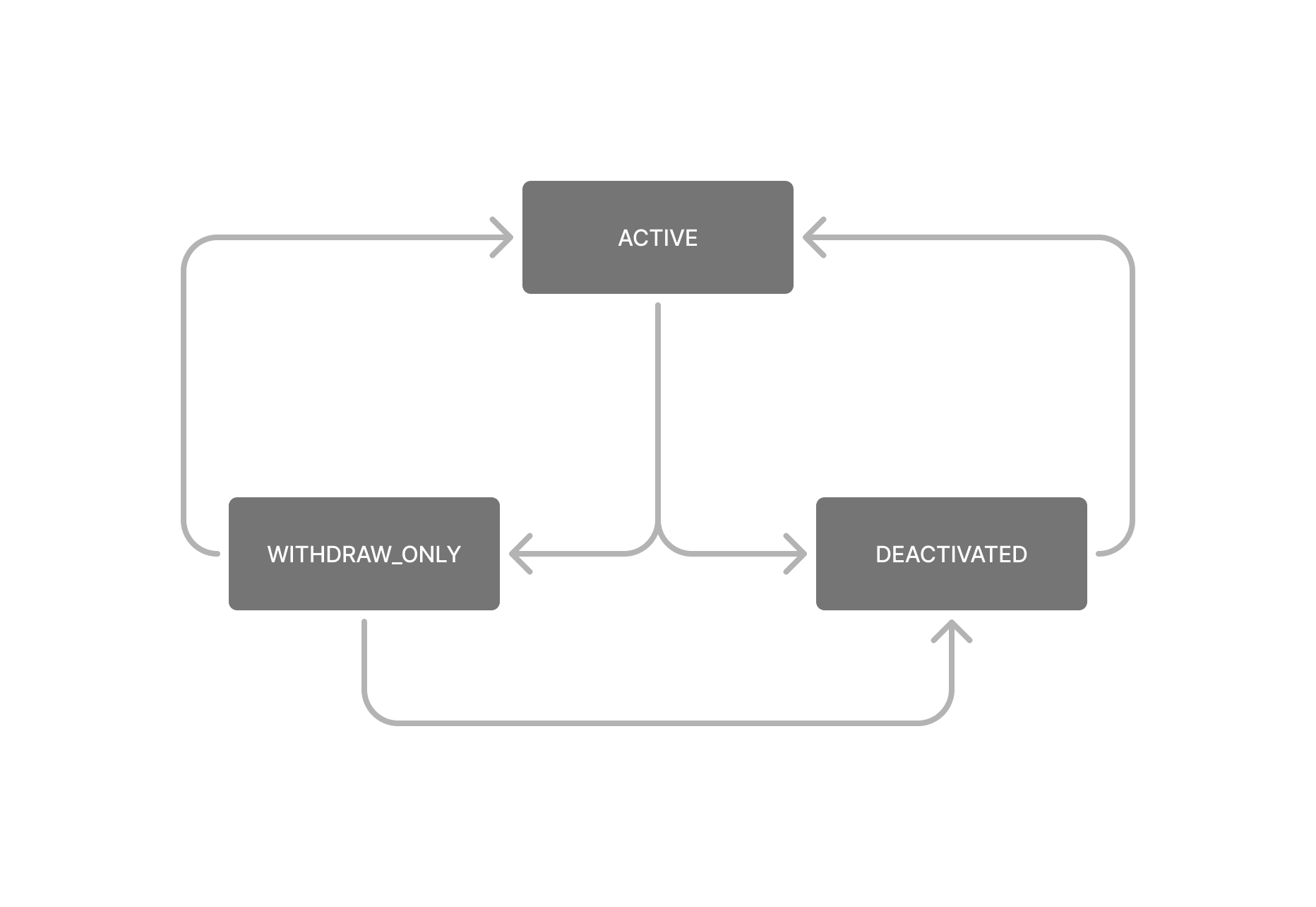

The possible previous_state and current_state values are:

ACTIVE- The user's account is active.WITHDRAW_ONLY- The user has 90 calendar days to remove their money from their balance before we fully close their account. This can be done through sending from their balance to themselves and others or spending with their card. The user will still be able to order new cards, convert between balances, open and close balances, and download balance statements. After 90 calendar days, the account will move into aDEACTIVATEDstate.DEACTIVATED- The user's account is deactivated and they will not be able to perform any actions on their account. The end-user tokens will be revoked and you will receive a401 Unauthorizedresponse for API calls.

- Event type:

kyc-reviews#state-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event is triggered when a KYC Review state has changed.

ID of the KYC Review.

Status of the KYC Review. See KYC Review Status for possible values and state diagram.

ID of the profile KYC Review belongs to.

Timestamp by which the underlying requirement set needs to be verified to not block the customer. Only relevant if the status is PASSED_WITH_REQUIREMENTS.

Timestamp marking the creation of the KYC Review.

Timestamp marking the last update of the KYC Review.

Type of the underlying action/process this KYC Review is for. Usually a reference to which product this KYC Review is for (like QUOTE or TRANSFER) or a reference to a KYC process on the profile that isn’t related to a specific product (like REFRESH_CYCLE or REPAPERING). Currently, only types QUOTE and TRANSFER are supported.

ID of the underlying product object. e.g. if type is TRANSFER then this would be transfer ID. This ID might be null if underlying action is a process like REPAPERING.

{"data": {"resource": {"id": "46e1a5c4-4a9b-4563-39d3-18174d3ac0f8","state": "WAITING_CUSTOMER_INPUT","profileId": 22016766,"requiredBy": "2024-09-03T16:22:02.257725","createdAt": "2024-09-03T16:22:02.257725","updatedAt": "2024-09-03T16:29:41.147522","triggerReferences": [{"type": "QUOTE","triggerData": {"id": "ba83s43a-f623-46f0-956d-196c13e2ab01"}}]}},"subscription_id": "8df95817-8085-40aa-9bda-e3bf46e7a21a","event_type": "kyc-reviews#state-change","schema_version": "2.0.0","sent_at": "2024-09-03T16:29:42Z"}

- Event type:

cards#3ds-challenge - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event is triggered when a customer initiates a push notification for 3DS. The provided information can be used to send a push notification to the customer's mobile app.

Your api_client_id

Card token

Profile ID

Resource type (always card)

The number of seconds before the challenge expires

When the challenge is triggered

The challenge method chosen by customer (always PUSH)

Transaction reference, you should use this field when notifying us of the challenge result.

User agent (usually browser or app)

Merchant category code, this field could be null

Merchant country, it follows ISO 3166-1 alpha-2 standard

Merchant name

Merchant url, this field could be null

Transaction amount

Currency code

{"data": {"challenge_expires_after": 300,"challenge_method": "PUSH","occurred_at": "2024-09-05T06:47:15Z","resource": {"card_token": "3ab81206-d258-4caf-cea5-60067ba82404","client_id": "tw-test-card-issuance","profile_id": 29751964,"type": "card"},"transaction": {"channel": "browser","merchant": {"category": null,"country": "AD","name": "Cards API BBT","url": "http://intrepid-fav.net"},"money_value": {"currency": "EUR","value": 100},"reference": "148990660"}},"event_type": "cards#3ds-challenge","schema_version": "2.0.0","sent_at": "2024-09-05T06:47:15Z","subscription_id": "ec6d37c2-4611-457a-b210-d1a5f4e354c7"}

- Event type:

profiles#overdraft-limit-threshold - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This event is triggered when the overdraft limit usage has reached 70% threshold. The event at each threshold is triggered maximum once per hour.

Profile resource type (always profile)

ID of the profile.

Overdraft limit used.

Overdraft limit approved.

Currency in which the amounts are expressed in.

{"data": {"resource": {"type": "profile","id": 111},"overdraft": {"used": 12000,"limit": 20000,"currency": "EUR"}},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "profiles#overdraft-limit-threshold","schema_version": "2.0.0","sent_at": "2020-01-01T12:34:56Z"}

- Event type:

account-details-order#order-state-change - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

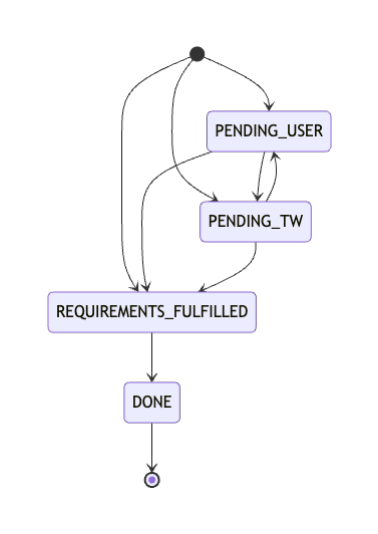

This event is triggered when there is a change in the state of an account details order. The event contains information about the order state and requirement state.

The possible values for an order are:

PENDING_USER: One or more requirements has some pending action from the user.PENDING_TW: One or more requirements has some pending action from Wise.REQUIREMENTS_FULFILLED: All requirements are completed and pending account details to be created.DONE: All requirements are completed and account details has also been created.

The more common requirements are:

VERIFICATION: The user needs to be fully verified before completing this requirement.

When the order was created

Currency code for the account details order

Whether account details have been issued for this order

When the order was last modified

Unique identifier for the account details order

Current status of the order (PENDING_USER, PENDING_TW, REQUIREMENTS_FULFILLED, DONE)

ID of the profile associated with this order

List of requirements for this order

Status of the individual requirement (DONE, PENDING, etc.)

Type of requirement (VERIFICATION)

{"data": {"creation_time": "2025-08-08T07:49:27Z","currency": "CAD","is_account_details_issued": false,"modification_time": "2025-08-08T07:49:30Z","order_id": "01989c58-45e4-71dd-9373-7d999e992f99","order_status": "REQUIREMENTS_FULFILLED","profile_id": 28835473,"requirements": [{"status": "DONE","type": "VERIFICATION"}]},"event_type": "account-details-order#order-state-change","schema_version": "2.0.0","sent_at": "2025-08-08T07:49:31Z","subscription_id": "01989c58-7171-7276-9a4c-c9b4cefc0897"}

- Event type:

transfers#transfer-suspension - Profile level subscriptions: Not Supported

- Application level subscriptions: Supported

This webhook triggers when a transfer is suspended due to an issue preventing it from proceeding. The event payload indicates the issue type, and user should perform the corresponding actions to allow the transfer to continue.

Here is the list of suspension issue type and its high level description:

| Issue type | Description |

|---|---|

| receive-less-than-invoice | Funds have been received for the transfer, but the amount is less than the invoice amount, another payment with the remaining amount is required to proceed |

| rate-confirmation | The exchange rate of the transfer has expired and a new mid-market rate is used for the transfer, user confirmation might be required to proceed |

Whenever the receive-less-than-invoice suspension issue type is triggered, it indicates that the funds received for the transfer are less than the invoice amount. Two options are available:

- To proceed with the transfer, an additional payment covering the remaining amount is required.

- Alternatively, you can choose to cancel the transfer. The received funds will then be refunded to the sender.

If no action is taken, the transfer will remain suspended for 5 days. After this period, the transfer will be automatically canceled, and any received funds will be refunded to the sender.

Suspension issue type, refer to the table above for the list of available types and their descriptions.

Transfer resource type (always transfer)

ID of the transfer

Identifies the Wise profile associated with this transfer. Might be null.

ID referring to the initial beneficiary of the payment. Might be null.

The date and time the event is sent

{"data": {"type": "receive-less-than-invoice","resource": {"id": 55129748,"account_id": null,"type": "transfer","profile_id": null}},"subscription_id": "2f1adb61-f925-48a4-9948-b7120c3961d0","event_type": "transfers#transfer-suspension","schema_version": "2.0.0","sent_at": "2025-06-05T08:04:36Z"}

At Wise, exchange rates are guaranteed for a limited time period. If your transfer's guaranteed rate expires before we receive your payment, the transfer will automatically switch to a floating rate. This means the final exchange rate will be determined based on the mid-market rate at the exact moment we receive your funds.

When we receive your payment after the original rate has expired, one of two scenarios will occur:

Scenario 1: Favorable Rate Change

If the new mid-market rate is equal to or better than the expired rate, your recipient will receive the same amount or more. In this case:

- The transfer proceeds automatically

- No action is required

Scenario 2: Unfavorable Rate Change

If the new mid-market rate is worse than the expired rate, your recipient would receive less than originally expected. In this case:

- The transfer suspends automatically

- A

rate-confirmationissue type webhook event is triggered - Customer must review and accept the new rate before the transfer can proceed

To accept the new rate, user can use the following endpoint:

PATCH {{host}}/v3/profiles/PROFILE_ID/transfers/TRANSFER_ID/activecases/rate-confirmation{"type": "rate-confirmation","decision": "accepted"}

You will need to replace PROFILE_ID and TRANSFER_ID accordingly.

Rate Validity Period After a new rate is determined and given, it will be valid for 48 hours. If the customer does not accept the new rate within this period, the transfer will be automatically canceled, and any received funds will be refunded back to the sender.

Suspension issue type, refer to the table above for the list of available types and their descriptions.

The new rate provided for the transfer.

The old rate that has expired.

The date and time the previous rate expired.

Transfer resource type (always transfer)

ID of the transfer

Identifies the Wise profile associated with this transfer. Might be null.

ID referring to the initial beneficiary of the payment. Might be null.

The date and time the event is sent

{"data": {"type": "rate-confirmation","resource": {"id": 12345,"profile_id": 222,"account_id": 333,"type": "transfer"},"rate": 1.2345,"expired_rate": 1.3456,"expired_at": "2020-01-01T12:34:56Z"},"subscription_id": "01234567-89ab-cdef-0123-456789abcdef","event_type": "transfers#transfer-suspension","schema_version": "2.0.0","sent_at": "2020-01-01T12:34:56Z"}