These APIs allow you to retrieve information on transactions that are made on your user's cards.

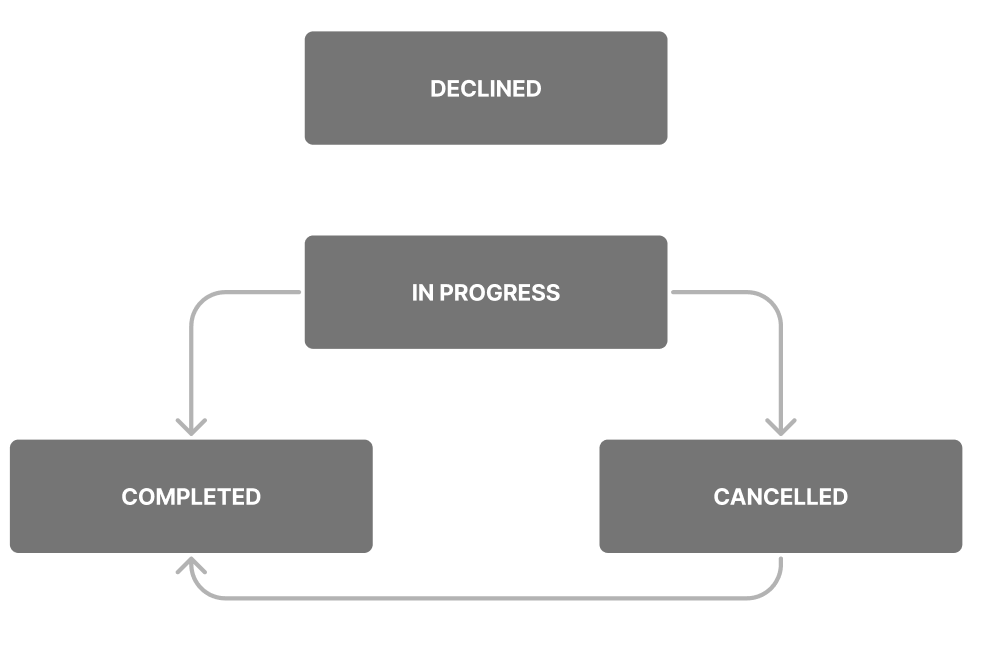

The possible state values are:

IN_PROGRESS- The transaction has been authorized but not captured.COMPLETED- The transaction has been captured and/or settled.DECLINED- The transaction has been declined.CANCELLED- The transaction has been cancelled.UNKNOWN- Default fallback status if the state can't be confirmed.

The transition from CANCELLED to COMPLETED is an edge case. Wise is releasing the customer funds after 7 days (30 days for pre-authorization) if the merchant has not capture the transaction, the state becomes CANCELLED. But the merchant can decide to capture the transaction on a later date, the state will then be COMPLETED.

The decline reason field provides information about the specific issue that led to the transaction being declined, helping the merchant and the customer troubleshoot the problem.

While the 'decline reason' field provides valuable information about the specific issue that led to the transaction being declined, it may not cover all possible reasons for a decline, such as technical issues or unforeseen circumstances.

Please be aware that new decline reasons may be added in the future, and not all decline reasons are currently documented. Therefore, it is important to exercise caution and regularly review the documentation to ensure accuracy.

Balance related to the transaction is not active.

Please ensure that all outstanding actions have been completed before using your card, as this may help avoid any potential issues or declines.

This transaction has been declined pending further compliance checks.

It may have been flagged for potential sanctions issues.

PIN change via ATM terminal is not allowed.

Transactions were made in unsupported countries.

Check out this link to see if the country is included in our list of supported nations.

It is possible for a merchant to be based in a supported country and have an address registered in a blocked country, albeit infrequently.

Our system cannot facilitate this transaction as the customer has opted out of recurring payments with this merchant.

The card provided has reached its expiration date, making it invalid for this transaction.

The customer or our customer service team has put this card on a temporary hold.

If the card has not been frozen by the customer, it may be worth investigating further.

To resume spending, advise customer to unfreeze the card.

The card is either not active or has not been received by the customer, so we are unable to proceed with the transaction.

The card has been blocked and can't be used anymore.

Our internal team has deactivated the account for compliance reasons related to AML, fraud, or EDD.

Please contact our team if you believe this is an error.

The PIN is restricted on the chip of the card due to excessive incorrect entries.

The blocked PIN can be unlocked at an ATM using specific steps that vary depending on the machine and country, such as PIN management or PIN operations followed by unblocking the PIN.

There's a connection problem occurring during the transaction.

Contactless payment systems sometimes require a PIN for authentication purposes to protect users' accounts from potential fraud or tampering.

In Europe, contactless payment transactions that follow one after the other require PIN verification as an additional security measure.

Credit is not supported for this specific transaction. Please review our Acceptable Use Policy for further information.

In certain jurisdictions, there are restrictions on the amount that can be spent. For further details, please refer to the following resource about spending limits.

There's a problem with the message from the processor, so we might not be able to accept it because it could be incomplete or unsafe.

Just because we can't process the payment right now doesn't mean there's anything wrong with the card.

Tell the customer that there was a technical issue with the payment and to try again later.

The customer accidentally entered the wrong security code.

Please advise the customer to check their card details and try again.

If the customer's saved card details are correct, they should remove their card details from the merchant's website and then add them back again.

The customer made a mistake and entered the wrong expiration date for their card.

If the customer's saved card details are correct, they should remove their card details from the merchant's website and then add them back again.

The customer entered their PIN incorrectly.

Please advise the customer to check their PIN and try again.

If the PIN is correct and still fails, kindly suggest resetting the PIN.

The customer doesn't have enough money in their account to make the payment.

Please advise the customer to add money to their account and try again. In most cases, this will resolve the issue.

The 3D Secure checks failed during the transaction, so the customer should try again and ask for authentication.

ARQC (Authorization Request Cryptogram) is a cryptogram generated by the card during a transaction, which we validate on our end. If it's incorrect, it could indicate a faulty card, a fraudulent attack, or an issue with the POS terminal.

ICVV (Integrated Circuit Card Verification Value) is a security feature used to validate the authenticity of a card during chip-based transactions. There were problems reading the chip on the card, which may indicate an issue with the card's chip, the terminal, or the transaction process. It is best to wait a bit and try again.

Transaction from a specific merchant is declined by scheme. The merchant should clarify the exact cause with scheme.

We don't support certain types of transactions, so the customer should ask the merchant to use a different payment method or try a different merchant.

The transaction was declined because our system doesn't support conversions for Brazilian cards when BRL is involved.

The BRL won't be automatically exchanged to other currencies.

If the customer wants to continue with the payment, they need to change the currency they're using.

Currently, we do not provide ATM withdrawal services in the country where your transaction is taking place using your card.

At present, we do not offer support for this currency in this transaction.

At present, we do not offer support for transactions in this category for customers in the country of purchase. Please consider using an alternative payment method or changing merchant.

The customer has reached lifetime spending limit.

Please advise if they would like to increase their lifetime limit.

This payment type has been disabled

Please advise if they would like to enable the payment type.

The customer has exceeded transaction limit for the card.

Please advise if they would like to update their card limit.

The customer has reached the maximum number of allowed online PIN entry attempts.

To avoid further inconvenience, we recommend implementing a reset PIN feature within your app to help the customer regain access to their card.

The customer has attempted to make a contactless payment at a Point of Sale (POS) or ATM, but their card has not been activated for chip and PIN transactions.

If you would like to modify the card activation strategy for all your cards, please contact your implementation manager for assistance.

Our system is currently experiencing technical difficulties.

Please advise the customer to try again after a brief period of time.

Although rare, restricted mode can happen, and it's advisable to advise the customer to replace their card promptly as our system should have already informed them.

In this mode, more secure payment methods like chip and PIN, contactless, mobile wallets, and online payments with 3DS are allowed, while less secure methods like magnetic stripe and online payments without 3DS are not permitted.

The merchant has issued a reversal instruction for a different currency than what was originally requested during the authorization process.

We cannot proceed with the transaction due to SCA regulations.

Kindly suggest to the customer that they contact the merchant and use a more secure authentication method such as 3DS.

For example, customer can try to use chip & pin, or mobile wallet like (Apply Pay or Google Pay).

This transaction has been flagged by the scheme and cannot be processed.

Our system has detected that the POS terminal was misconfigured and failed our security checks.

Kindly suggest to the customer that they use an alternative payment method like contactless or mobile wallets, or recommend that they ask the merchant to accept a signature instead.

The merchant has entered the wrong type of purchase.

Please advise the customer to contact the merchant and ask them to correct this issue.

To proceed with this transaction, we require customer to enter their PIN.

Please advise the customer to enter their PIN to continue.

This transaction has been labeled as high-risk by Wise.

If you have any questions or concerns, please reach out to us.

This transaction has been flagged as high-risk based on our AML compliance protocols.

Please be aware that we cannot disclose this reason to your end customers.

Please contact us if you believe this classification is incorrect.

Our compliance system has flagged this transaction as high-risk.

Please be aware that we cannot disclose this reason to your end customers.

If you believe this classification is in error, please reach out to us for further assistance.

This transaction has been blocked based on our fraud policies and procedures.

Please contact us if you have any questions or concerns.

This transaction has been flagged as high-risk based on our sanctions list analysis.

Please be aware that we cannot disclose this reason to your end customers.

Unfortunately, this classification is final and cannot be appealed.

We cannot process this e-commerce transaction due to high risk factors. We require the merchant to complete 3DS before we can approve the transaction.

We have restrictions on this type of transaction, and sometimes the scheme won't allow it.

Please check if spend control is set up to block this transaction.

There may have been a communication error between the merchant's system and our server, but the POS system may have already notified the user of this issue.

ID of the transaction

Unique identifier of the card

Type of the transaction

Code of the decline reason if applicable

When transaction or transaction state change occurred

The current state of the transaction

Last 4 digits of the card

Transaction amount

Currency code

Fee amount

Currency code

Fee type

Transaction amount including fees

Currency code

Name of the merchant

Country where merchant is located

City where merchant is located

Zip code where merchant is located

Region where merchant is located

State where merchant is located

Category of the merchant

MCC code of the merchant

Description of the merchant

Authorisation method

Associated balance transaction ID if applicable

Balance ID

Amount taken from the balance

Currency code

Amount converted to

Currency code

Exchange rate

Conversion fee amount

Currency code

Balance ID

Amount credited to the balance

Currency code

{

"id": "342671",

"cardToken": "59123122-223d-45f9-b840-0ad4a4f80937",

"type": "ECOM_PURCHASE",

"declineReason": null,

"createdDate": "2022-11-28T08:17:54.241236Z",

"state": "IN_PROGRESS",

"cardLastDigits": "3086",

"transactionAmount": {

"amount": 1.5,

"currency": "SGD"

},

"fees": [],

"transactionAmountWithFees": {

"amount": 1.5,

"currency": "SGD"

},

"merchant": {

"name": "Test Payment",

"location": {

"country": "France",

"city": "Rouen",

"zipCode": "00000",

"region": null,

"state": null

},

"category": {

"name": "RMiscellaneousAndSpecial",

"code": "5999",

"description": "5999 R Miscellaneous and Special"

}

},

"authorisationMethod": "MANUAL_ENTRY",

"balanceTransactionId": 2598366,

"debits": [

{

"balanceId": 52832,

"debitedAmount": {

"amount": 1.06,

"currency": "EUR"

},

"forAmount": {

"amount": 1.5,

"currency": "SGD"

},

"rate": 1.43073,

"fee": {

"amount": 0.01,

"currency": "EUR"

}

}

],

"credit": null

}GET /v3/spend/profiles/{{profileId}}/cards/transactions/{{transactionId}}

Retrieve a card transaction based on its transaction ID.

The possible type values are:

ACCOUNT_CREDIT- Receiving money on the card, excluding Visa OCT or Mastercard MoneySendACCOUNT_FUNDING- Sending money to another card or e-walletCASH_ADVANCE- Cash disbursementCASH_WITHDRAWAL- ATM withdrawalCHARGEBACK- Currently unused. Reserved for future use.CREDIT_TRANSACTION- Visa OCT and Mastercard MoneySendECOM_PURCHASE- Online purchasePOS_PURCHASE- Purchase via a POS TerminalREFUND- Partial or full refund of an existing card transaction

The possible state values are listed here.

When a refund happens, a separate transaction will be added with a REFUND transaction type.

curl -X GET \

https://api.wise-sandbox.com/v3/spend/profiles/{{profileId}}/cards/transactions/{{transactionId}} \

-H 'Authorization: Bearer <your api token>'{

"id": "342671",

"cardToken": "59123122-223d-45f9-b840-0ad4a4f80937",

"type": "REFUND",

"declineReason": null,

"createdDate": "2022-11-28T08:17:54.241236Z",

"state": "IN_PROGRESS",

"cardLastDigits": "3086",

"transactionAmount": {

"amount": -1.5,

"currency": "SGD"

},

"fees": [],

"transactionAmountWithFees": {

"amount": -1.5,

"currency": "SGD"

},

"merchant": {

"name": "Test Payment",

"location": {

"country": "France",

"city": "Rouen",

"zipCode": "00000",

"region": null,

"state": null

},

"category": {

"name": "RMiscellaneousAndSpecial",

"code": "5999",

"description": "5999 R Miscellaneous and Special"

}

},

"authorisationMethod": "MANUAL_ENTRY",

"balanceTransactionId": 2598366,

"debits": [],

"credit": {

"balanceId": 52832,

"creditedAmount": {

"amount": 1.5,

"currency": "SGD"

}

}

}